5 Things You Need to Know About Big Box Logistics In Q1 2024

- Q1 take up has reached 6 million sq ft – down 16% quarter-on-quarter

- The DTRE Big Box Vacancy Rate has crept up to 7.2% up from 6.9% at the turn of the year – but we believe this will be the ‘peak’ vacancy

- The latest MSCI Monthly Index for end March showed annualised rental growth of 6.9% for the industrial sector

- Hesitancy in the capital markets has meant that just £1.1bn of industrial and logistics has traded over the quarter, down 21% on the 10-year ‘pre-Covid’ average (2010-19).

- Significant dry powder continues to admire the sector, and with the Big Box vacancy rate about to turn a corner, real rental growth continuing and a 25 bps cut to interest rates to come in Q3, we remain hopeful of a busy end to the year.

Occupational

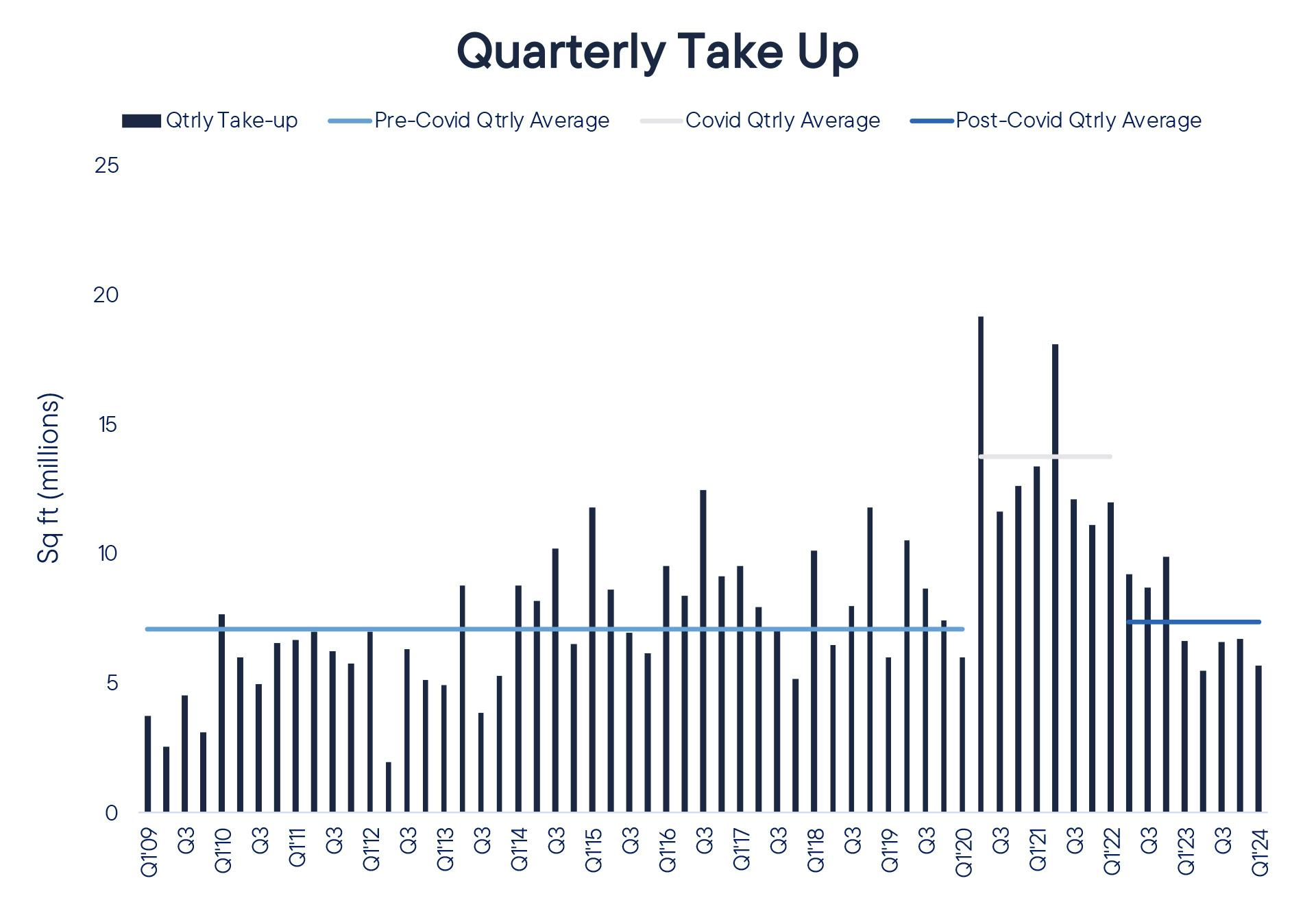

The occupational market has got off to a sluggish start in 2024, with a combination of factors ensuring that the quarterly volume for new lettings reached just 5.6 million sq ft, that’s down 16% quarter-on-quarter and the slowest start to a year since 2019. However, there remains reasons to be positive as we move into the second quarter.

Whilst the slowdown in occupier demand can be attributed to a number of macro-economic factors, ‘transaction friction’ has also increased significantly. Legal and ESG due diligence processes appear to be the main contributors, although C-Suite decision making is slower than it has been.

However, DTRE are currently tracking 7.6 million sq ft of logistics units that are under offer and should all those units complete by the end of June 2024 then take-up for the half-year will be 10% ahead of the “Pre-Covid” average.

Looking at Q1, the Midlands led the way accounting for almost 60% of all demand, split 40% East Midlands and 19% West Midlands, with Yusen Logistics’ 1.2 million sq ft pre-let at SEGRO’s Northampton Gateway accounting for 47% of the Midlands total.

In total, twenty-two deals signed across the first three months of the year, with 100,000 - 300,000 sq ft being the most popular building size, accounting for 77% of take up. Positively, particularly given the availability of assets in the 300,000 sq ft size bracket, take-up for bigger units was 14% ahead of the “pre-Covid” quarterly average (2007-19).

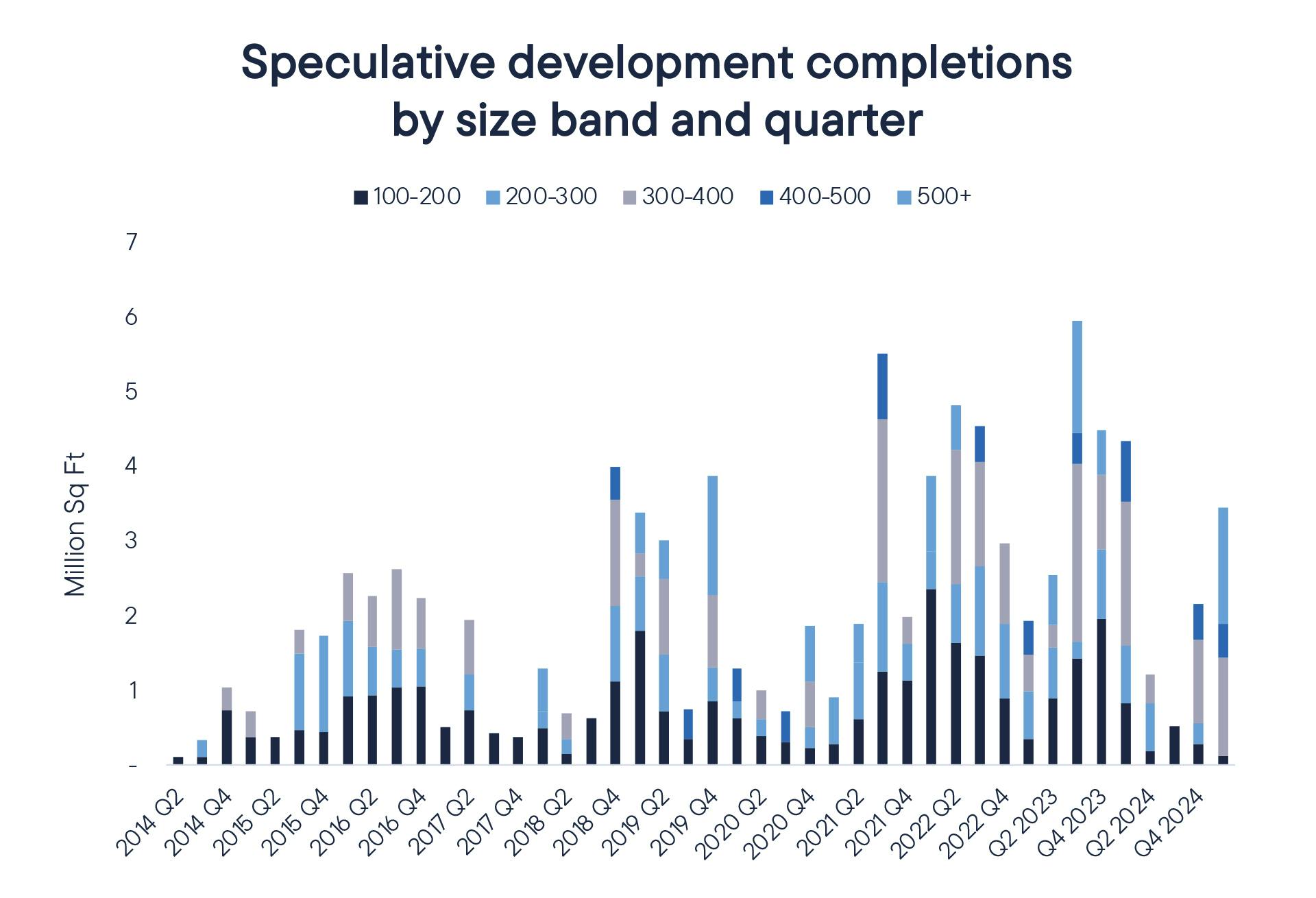

The level of supply and in-turn the vacancy rate has continued to creep up at the start of 2024, albeit it at a much slower rate than we saw throughout 2023. By end Q1 2024, the DTRE Big Box Vacancy Rate had only reached 7.2% up from 6.9% at the turn of the year.

However, we believe this will be the ‘peak’ vacancy and that the headline rate will trend downwards through the remainder of the year. There is only 7.6 million sq ft of new speculative development due to complete in 2024 – this will be the lowest level of new speculative completions of Big Boxes in seven years.

At the end of 2023, there were 24 assets available in the 300,000-400,000 sq ft size range; encouragingly 5 units are now under offer and with no significant new supply expected, this sector should see further decreases as the year progresses.

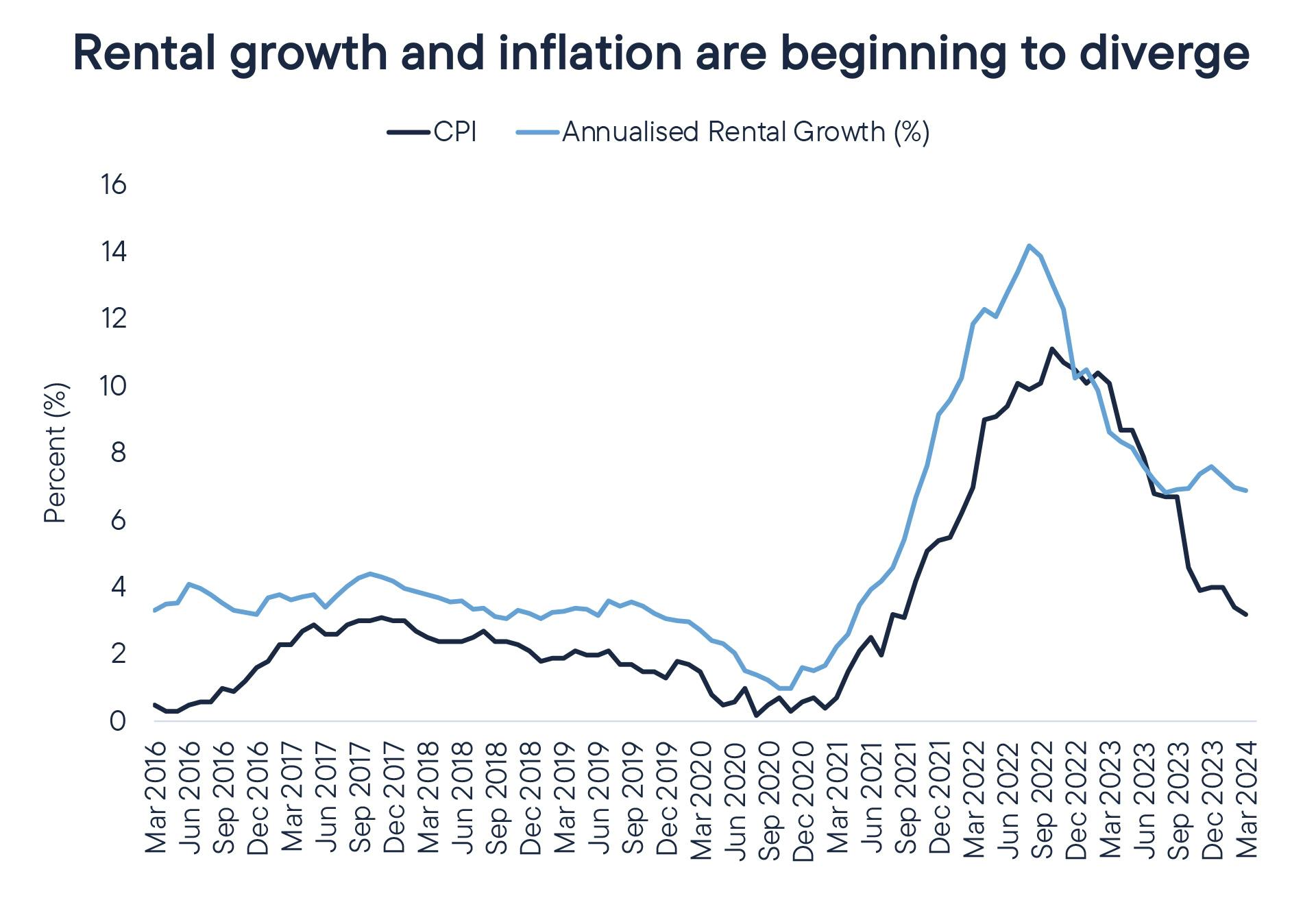

Finally, rental growth continues strongly and is being driven by the demand/supply dynamics that have underpinned industrial and logistics for the past ten years, rather than inflationary pressures. The latest MSCI Monthly Index for end March showed annualised rental growth of 6.9% for the industrial sector (see below).

Whilst rental growth had tracked closely with the UK’s CPI for much of 2023, by autumn it had de-coupled, and we are now seeing real rental growth of 370 basis points over the latest annual CPI number of 3.2% for March.

Capital Markets

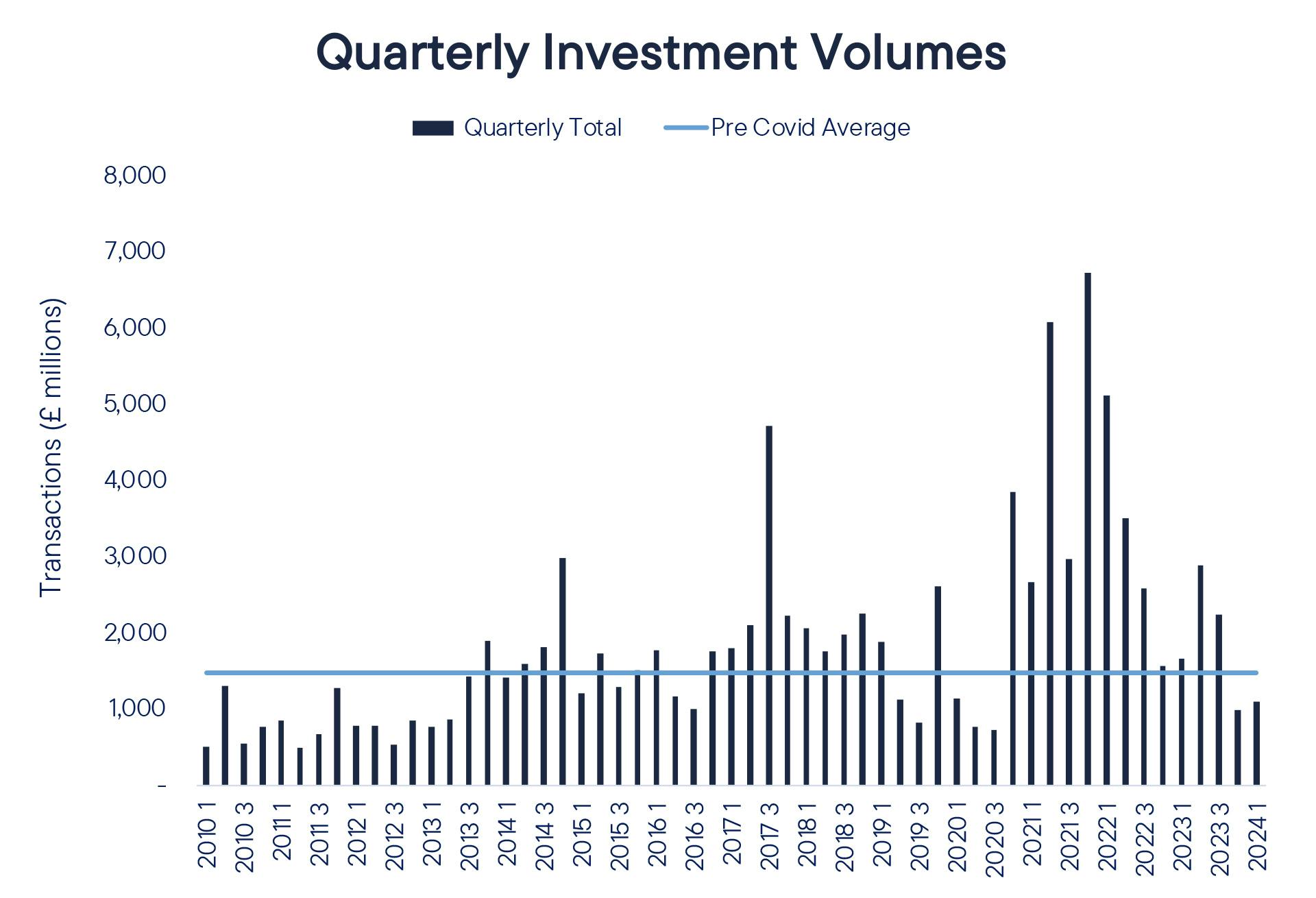

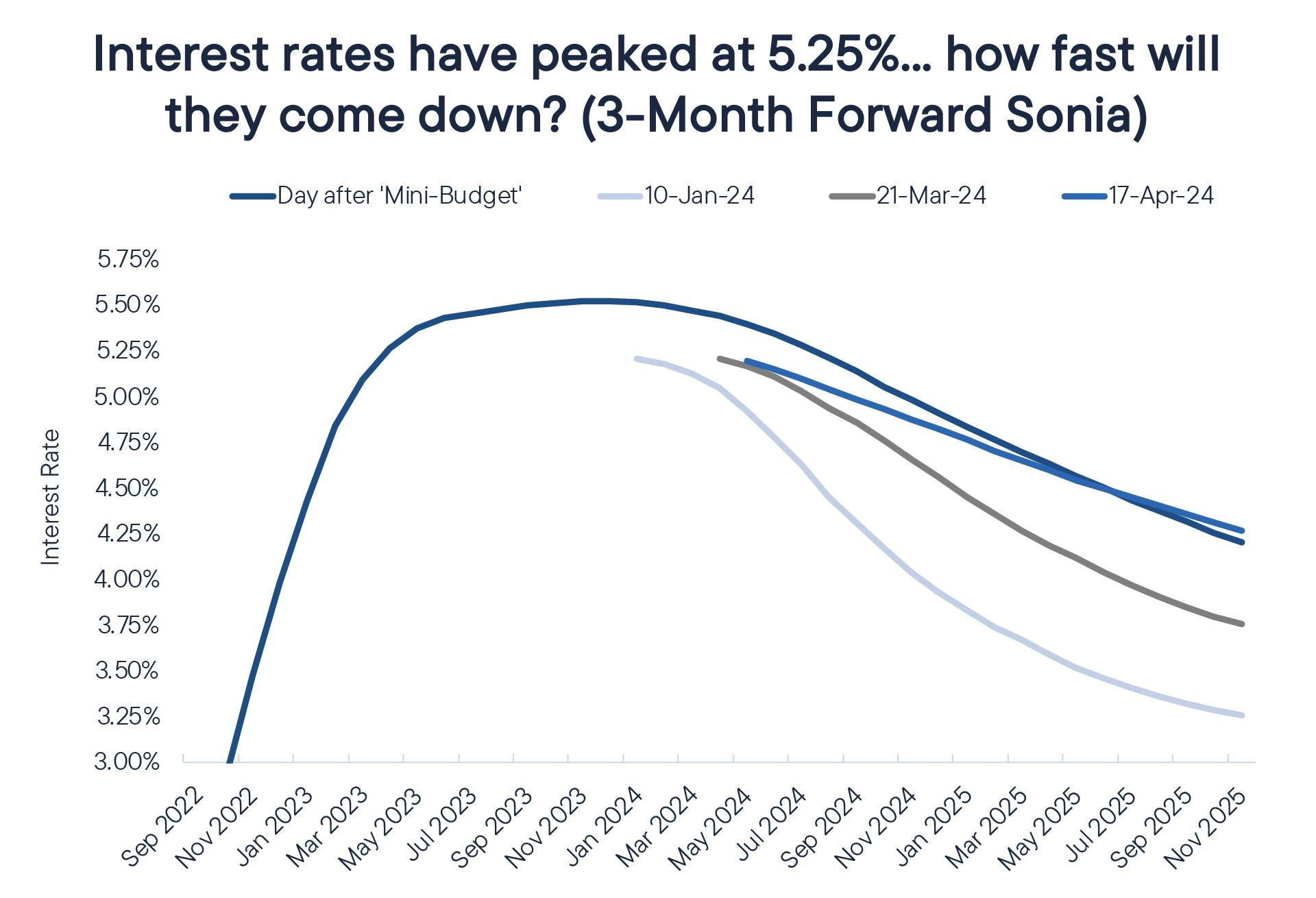

The themes that have dominated the capital markets for the last twenty-four months continue to persist and whilst bouts of optimism have appeared over the first three months of the year, they have also receded just as quickly, as capital sits on the side lines awaiting a definitive signal from the world’s central bankers.

The result of this hesitancy in the capital markets has meant that just £1.1bn of industrial and logistics has traded over the quarter, down 21% on the 10-year ‘pre-Covid’ average (2010-19). Larger transactions and portfolios remain largely off the radar, and this is reflected in the fact that only four deals occurred over £50m in the quarter.

The biggest deal of the quarter saw the US fund manager Ares (advised by DTRE), purchase Project Armitage, a highly reversionary 1.84 million sq ft portfolio from Royal London for £175m/5.5% NIY in an off-market transaction. Elsewhere, the industrial & logistics apportioned pricing for the LondonMetric/LXI merger helped boost the end quarter volume by a further £163m.

Whilst the UK economy has turned a corner and the threat of a prolonged recession is in the rear-view mirror, the bond and swaps markets tell of the bumpy path endured year-to-date as well as providing a pre-cursor to what lies ahead.

At the start of the year and on the back of the US Federal Reserve signalling they were likely to undertake four rate cuts during the course of 2024, UK 10-year bond yields were trading at 3.4%, however, as the prospect of both a) when the first rate cut will be and b) how many there’ll be this year, the UK 10-year has moved upwards and now stands at 4.3% (17th April).

The swaps market tells a similar story, with 5-year swaps at 3.5% at the start of 2024 and now standing at just a nudge over 4.1% (17th April).

Whilst corporate activity in the listed sector is on the rise - as undervalued businesses receive attention from bigger players seeing an opportunity to create scale - in a pure property transaction sense, the shift in bond yields and swap rates since the start of the year has meant capital has been hesitant, particularly for the bigger ticket lot sizes. Unfortunately, we expect more of the same ‘wait and see’ approach for the next 3 months at least, with transaction volumes remaining depressed whilst the ‘bid/ask’ spread remains too wide.

Significant dry powder continues to admire the sector, and with the Big Box vacancy rate about to turn a corner, real rental growth continuing and a 25 bps cut to interest rates to come in Q3, we remain hopeful of a busy end to the year.