5 Things You Need to Know About Offices, Science & Technology in Cambridge

- Office and Laboratory take up in Cambridge reached 173,000 sq ft this quarter, a notable 47% uptick from Q2's levels

- Babraham Research Campus has witnessed a 65% rental uplift over the past 36 months

- DTRE are tracking over 880,000 sq ft of named laboratory demand

- Q3 brings office, science, and technology investment volumes to £139 million for 2023, with £88 million under offer Q3 brings office, science, and technology investment volumes to £139 million for 2023, with £88 million under offer

- Life Science & Bio-Tech companies have raised over £515 million in Q3, an increase of over £430 million (513%) on Q2, 4% ahead of the full year 2022 total

Cambridgeshire Q3 2023 Report

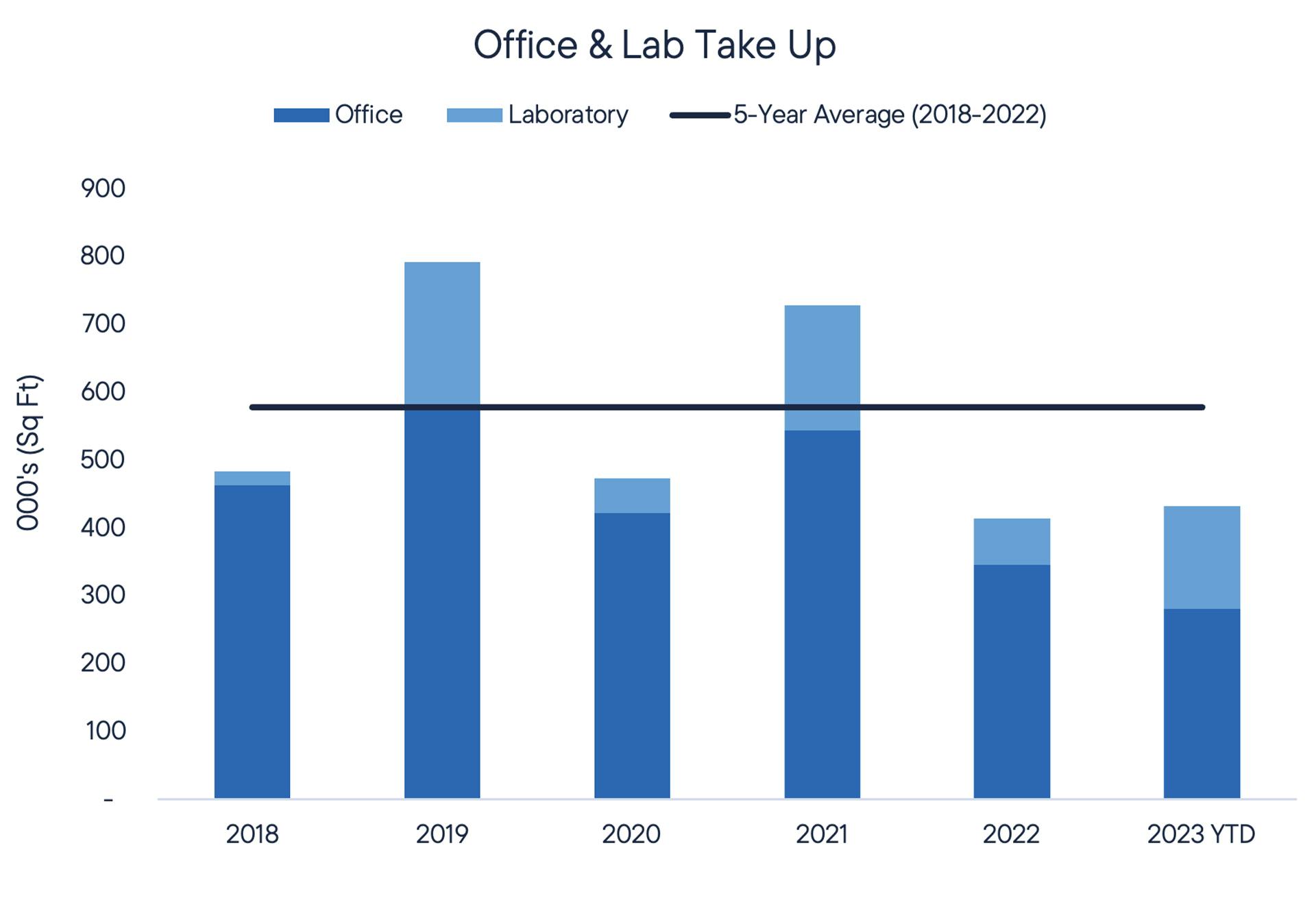

Office and laboratory take up in Cambridge reached 173,000 sq ft this quarter, a notable 47% uptick from Q2’s levels, driven by office transactions.

Tenant demand for the office, science and technology sectors remained unsatisfied this quarter, with the lack of up-and-built laboratory and Grade A office space continuing to persist.

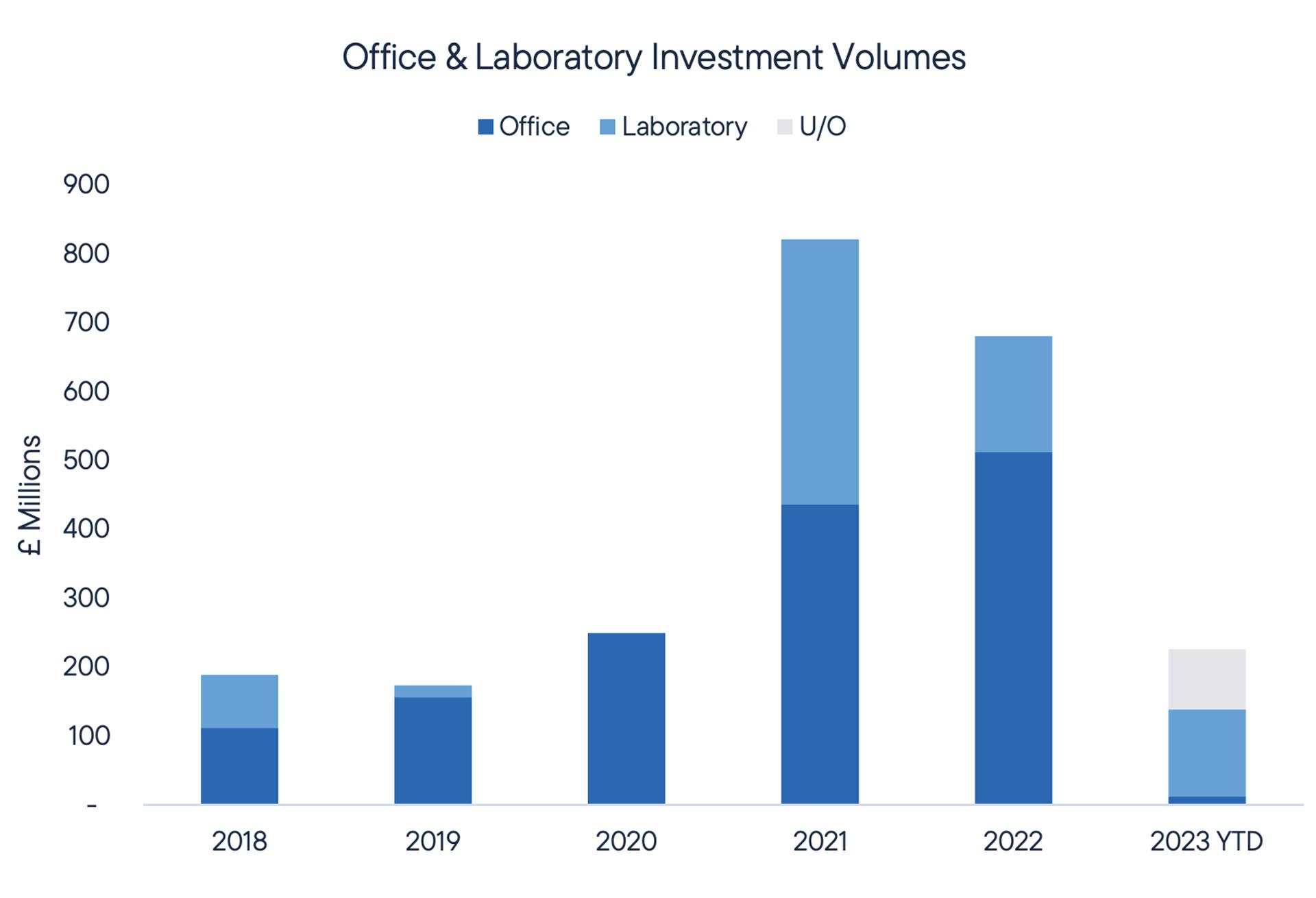

Combined office and laboratory investment volumes reached £139 million at the end of Q3, 14% above the 5-year full-year pre-pandemic average of £122 million, despite rising construction costs and softening yields.

Q3 witnessed Life Science ad Bio-Tech firms raise £515 million through fundraising and grants, an increase of £430 million (513%) on last quarter. Whilst VC fundraising activity is occurring, from discussions with occupiers it is taking noticeably longer to close the raises, as well as the macroeconomic factors adding to increased occupier sentiment of the importance of capital conservation.

Occupational

Science & Technology

Laboratory take up this quarter reached 40,000 sq ft, c.20,000 sq ft behind the previous quarter.

The letting of the latest new development at Babraham Research Campus, Building 960 by BioMed Realty, has accounted for 89% of total laboratory take up this quarter. The 34,000 sq ft fully fitted wet laboratory to complete in the opening quarter of 2024 has been pre-let to three occupiers. The largest of the lettings was Insmed taking 17,700 sq ft, followed by Xap Therapeutics leasing 10,200 sq ft, as well as Mosaic Therapeutics, a graduate of the Research Campus’ start-up programme, Accelerate@Babraham, taking the remaining 6,700 sq ft.

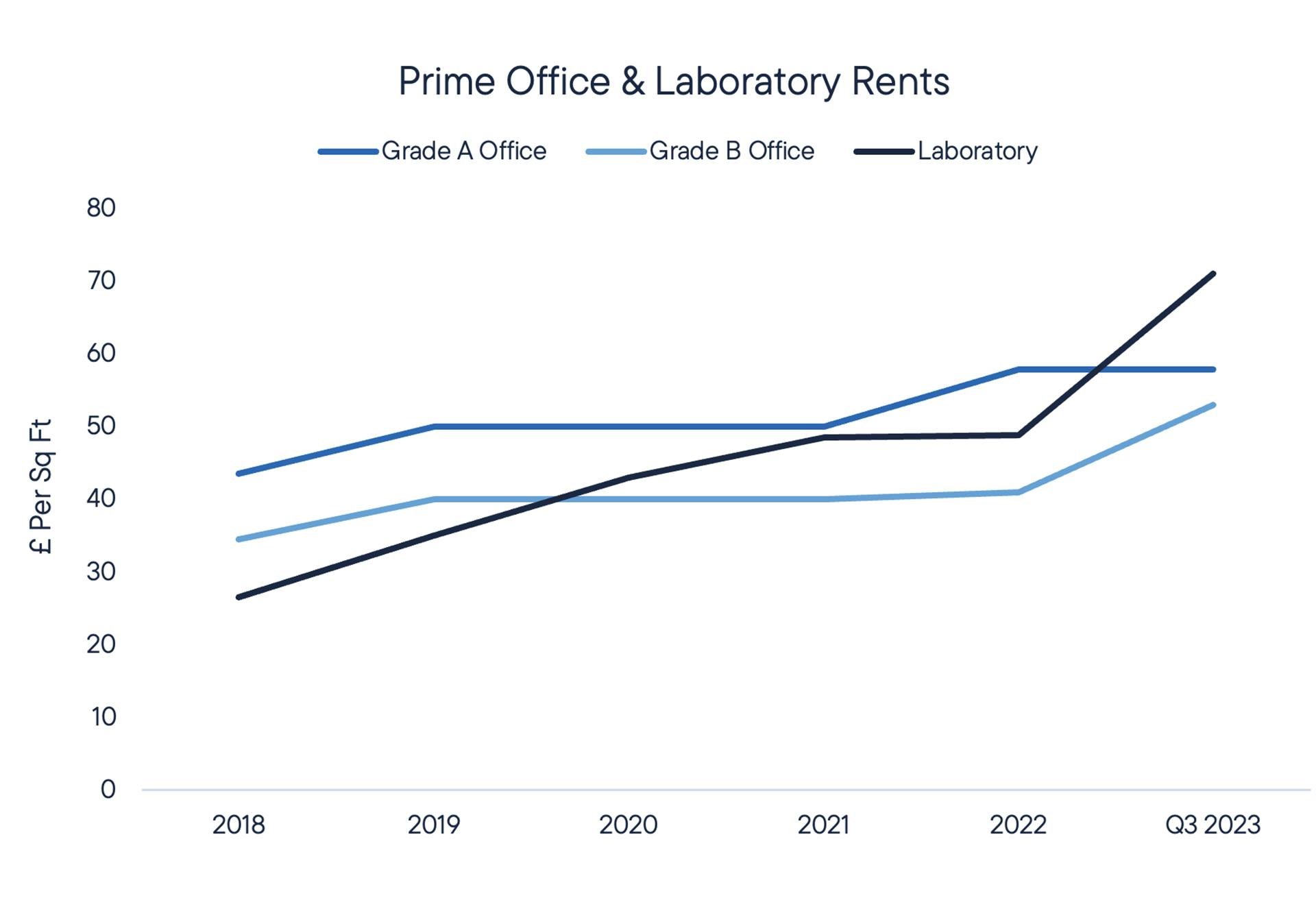

Despite a lower overall take up compared to last quarter, these transactions highlight the continued presence of demand for fitted laboratory space as the latest lettings at Babraham reflect rents in the range of £66-68 per sq ft for fully fitted labs, based on 5-year leases.

The prime rental level at Babraham Research Campus was £43.15 per sq ft 36 months ago, reflecting a rental growth uplift of 65% and a compound annual growth rate of 18.06%, supporting the sentiment that occupiers are happy to pay rents at a competitive level following the new prime laboratory rent set at the campus last quarter of £71.00 per sq ft.

Low take up can be attributed to the running theme of the 882,000 sq ft of active laboratory demand not being fulfilled by current supply. There are only 2 new laboratory developments currently under construction to complete by the end of the year, 1000 Discovery Drive and Phase 2 Unity Campus. Of the c.200,000 sq ft to complete, 70% is already leased or under offer.

Abstract Securities have just broken ground on a new speculative lab building at the South Cambridge Science Centre in Sawston. At 138,250 sq ft it is the largest speculatively built laboratory building currently under construction in Cambridge and will provide highly flexible, high quality laboratory space to foster collaboration and innovation, reaching completion in Q2 2025.

Life Science and Bio-Tech companies in Cambridge have raised £678 million this year to date through 83 raises and grants. £515 million was raised in Q3 alone by key fundraisings including the two largest fundraisings this year to date by Apollo Therapeutics Limited and CMR Surgical, raising over £180 million and £133.8 million respectively.

Office

Office take up across Cambridge in Q3 reached 131,000 sq ft, equating to 76% of combined office and laboratory take up and surpassing Q2’s office transactions by over 76,000 sq ft (139%).

Take up has focused on the serviced office/flex space, with the largest deal of the quarter being the serviced office operator, Mantle Space, taking and adapting 22,600 sq ft of former Invenia Labs fitted office space by way of assignment at 95 Regent Street, CB2. In the Cambridge North cluster, Newflex has leased 18,300 sq ft at One Cambridge Square near Cambridge North rail station to develop into serviced office space in one of the largest deals this quarter.

The new FORA serviced offices building at Station Road in the city centre also opened its doors during the summer and is steadily filling up, providing competition to the existing WeWork centre at 50/60 Station Road.

There was 163,500 sq ft of office space under offer in the northern cluster and city centre by the close of the quarter, a substantial amount driven by the 484,000 sq ft of DTRE-tracked demand, influenced largely by displaced occupiers coming out of buildings that are to be redeveloped.

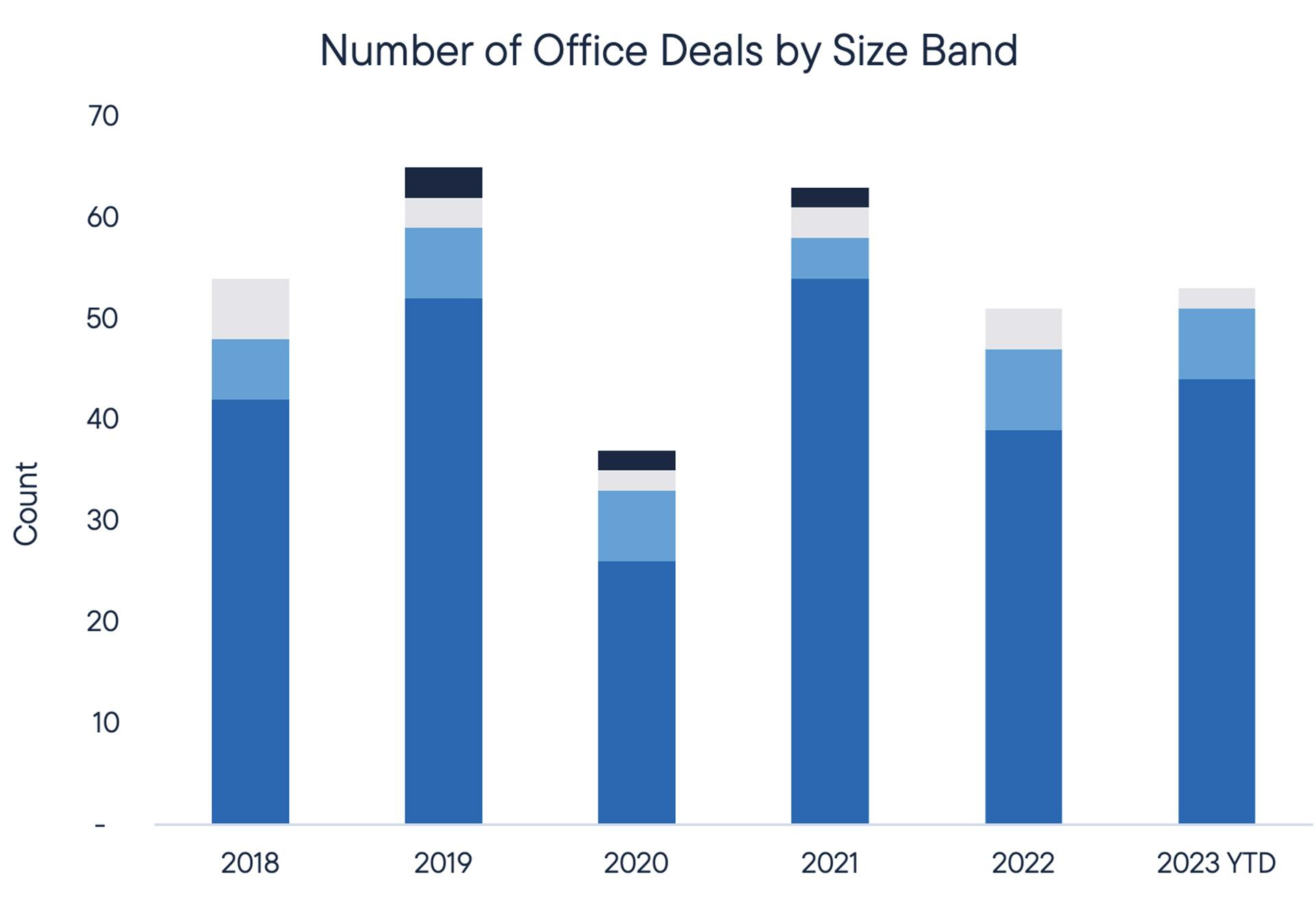

Q3 also followed the previously identified trend of the increase in deals occurring for smaller spaces, and the decline in larger-sized deals. With 19 office deals completing this quarter, 14 agreed leases were within the 0-10,000 sq ft size bracket. Furthermore, just one deal occurred between 20-50,000 sq ft, and no deals were recorded for leases above 50,000 sq ft.

By the end of the quarter, the overall office vacancy rate across Cambridge was 9.5%, but only 3.3% for new or modern Grade A offices, down from 4.1% in Q2.

One Cambridge Square is the only new office development in the northern cluster and is already 65% let. There are two new developments under construction in the city centre, 68,000 sq ft of space at Brooklands which is 41% pre-let, and 10 Station Road, the latest addition to the CB1 office quarter, which will deliver 50,440 sq ft by the end of 2024. Despite overall available office space in Cambridge rising by 44,000 sq ft (6.6%) since last quarter, it is due to the release of occupier space as corporates continue to rationalise their office portfolios in response to changing working practices and the development of the work-fromhome culture.

We are confident that much of this available space will be soaked up by the increase of tenants in the market and from the continued pressure on Grade A space as the flight to quality, over quantity, persists.

Investment & Development

Canmoor and Tristan Capital, advised by DTRE, have purchased a cluster of four buildings and development land assets at Dales Manor Business Park. Sold by Warehouse REIT, the 130,049 sq ft park was purchased with an underlying science and technology repositioning angle for £27.25 million.

Investment into the office, science and technology sector across Cambridge has reached £139 million so far this year. Whilst down on the surges of investment seen in the previous two years as investment flew in due to the pandemic, if the £88 million of space that is currently under offer comes through by the end of the year, investment volumes will reach £227 million, 86% above the pre-covid 5-year average (2015-2019).

Increases in material and construction costs, affected by inflation, alongside planning constraints, and yields continuing to move out, have supported the wake of the pandemic in restricting volumes so far this year.

At the close of Q3, the search to recapitalise large schemes continued on from H1 , with several £100 million in development funding opportunities available for the office, science and technology sector in Cambridge. Brockton Everlast offers the largest opportunity in its search for a Cambridge Science Park partner at over £300 million.

Despite the dip in investment volumes compared to the previous two years, we anticipate the market bouncing back, supported by the continuous strong demand in the golden triangle alongside the re-emerging confidence in buyers as the VC tap continues to flow.